Congratulations - you’ve done pretty much all of the work already! From here on out, you can think of these guides as a bonus to help you refine your pricing and packaging.

In Parts 2 and 3, you worked through defining both the price point your market might tolerate and the packaging that best aligned with their needs.

In this guide, we’ll dive into common packaging models, explore how to select a price metric, and highlight the three most common sales motions we see in the market.

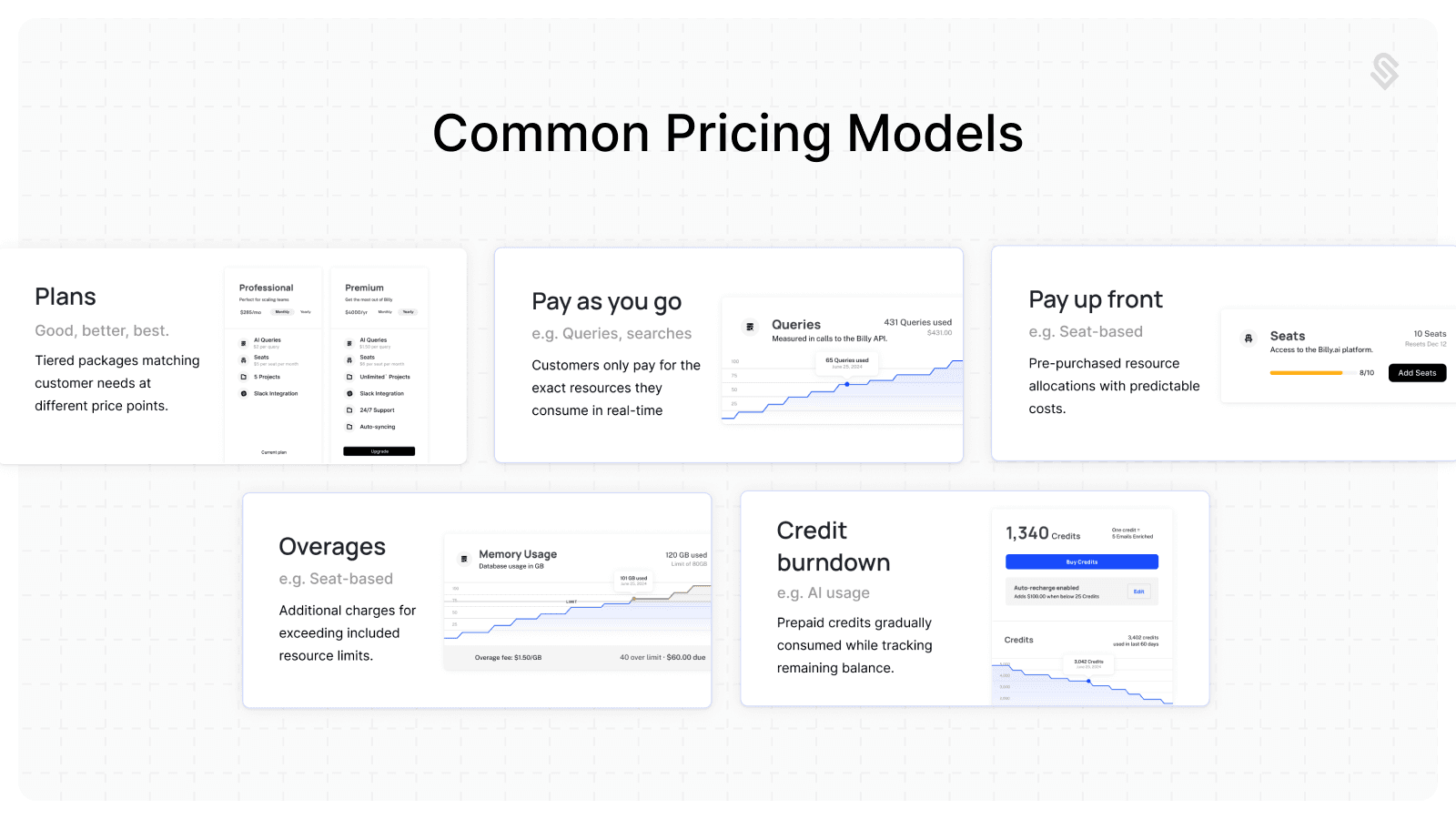

Common pricing and packaging models

We’ll list pricing and packaging models below based on their popularity today. We’re seeing quite a big shift in how products are sold due to new types of technology (e.g. AI) and use cases.

Often, we see a combination more than one of the models below (e.g. tiered pricing with a usage metric).

Tiered

This is the most common type of packaging model, offering tiers that provide different functionality depending on the use case. In many cases, this is the right choice for early stage companies that want a simple and easy to understand model.

Best for: Products that currently serve multiple customer segments or plan to with distinct requirements and budgets.

Downsides: When not paired with a price metric, can leave a lot of money on the table.

Examples: Most SaaS products with a free plan, a standard tier for SMBs with most core functionality, and a premium tier for enterprises with advanced

Per-seat

This model charges customers based on the number of users (or "seats") accessing the platform. This is distinct from “Usage-based pricing” because it’s a recognized pricing model that is used across product categories regardless of the value they’re delivering.

Admittedly, this type of pricing model has seen a significant amount of blowback in the recent past because it disincentives adoption. However, it is recognizable and effective to drive expansion revenue.

Best for: Collaborative products and software heavily influenced by team size.

Downsides: Disincentives adding teammates, which slows down adoption in some cases.

Examples: Products that are used across a team or an organization, such as CRMs, productivity software, etc.

Usage-based

In this model, pricing scales with actual usage, such as API calls, data storage, or transactions. Often this type of model might have a couple of dynamics: 1) it’s paired with a tiered model with limits or price points that change in higher tiers; or 2) it is offered with “buckets” of usage so that billing predictable

Best for: Products where value is directly correlated with usage.

Downsides: Several downsides:

Usage can vary month to month, which can be hard for buyers to budget and plan for.

Transparency is key so that customers trust they are being billed correctly.

If the price metric is not intuitive, it can also insert friction into the buying process.

Examples: Infrastructure providers like AWS or Stripe.

Success and outcome-based

This type of model has become more popular with AI-driven products. Customers pay based on achieving specific results or milestones.

Best for: Products where some kind of measurable output can be tied to product value.

Downsides: Many of the same downsides as usage-based pricing. In addition to those, given this is a relatively new model, it must be explainable to the buyer.

Examples: AI products or products with an AI component. For example, Intercom has a product that charges based on successful resolution of a support ticket.

Custom/opaque

This is effectively tailored pricing and packaging for each customer. For earlier stage companies, this is very likely how you might operate until you can pour concrete on a formal pricing and packaging model. After that time, you might always offer custom pricing for customers with more complex requirements.

Best for: Complex offerings with significant variability in value across customers.

Downsides: Requires price negotiation, which inherently introduces sales friction.

Examples: Many companies have a custom tier, but very few employ it as their only model.

Selecting a price metric without creating friction

More and more companies have some aspect of usage-based because the market is moving towards a desire to directly align what is paid to a service with the value it’s actually delivering.

You might have some information from your pricing discovery on how to assign the price metric that’s appropriate for your product, but here are a few rules:

Your price metric should increase the cost of your product in proportion to the value customers derive from your product.

It should reflect the value delivered to the customer.

It should be easy to measure and explain so that it avoids creating friction during buying, onboarding, or early adoption.

It should ensure long-term retention and expansion. Ideally you should see 30%+ of your revenue from expansion over time.

What are examples of a great price metric (although even great price metrics have critics!)?

Stripe: Charges a percentage of transactions processed, which directly aligns with the value they’re delivering.

Datadog: Prices based on the number of hosts monitored, which is easy to understand and plan for.

Aligning your sales motion with your pricing and packaging model

How you monetize is extremely important, and when your sales motion is aligned with that you can create a lot of magic.

There are three major sales motions we see in the wild that are worth noting. What you choose should be based on how you expect your customer to adopt and buy your product, as well as the competitive dynamics.

Again, these are not mutually exclusive tracks, but are often layered together to address different segments.

Self-serve

Prospects can self-onboard and self-convert. Often paired with transparent pricing and low-touch support.

Best for: When your customer is SMB or you are building a bottoms-up go-to-market motion.

Downsides: Given this is often low touch, the product must do a lot of the selling. If your product is immature or relatively complex, that might result in lower yield.

Example: Mintlify allows developers to onboard and start using their documentation platform without talking to sales.

Sales-led

Prospects must talk to a sales rep to purchase. Often involves formal qualification, a demo, and/or a proof-of-concept.

Best for: Complex or high-value offerings that require customization or ROI justification.

Downsides: High friction for the buyer and time intensive. For some buyers, it doesn’t match the persona (e.g. developers).

Example: Pylon uses sales teams to guide enterprise customers through custom implementation.

Open source

Similar to self-serve but the prospect can adopt and customize the solution to their needs without fear of losing the solution after adopting.

OSS models often have paid tiers that are hosted or supported.

Best for: Developer-led products that are widely applicable. Products that might be perceived as core (e.g. backend databases).

Downsides: Only appropriate for some personas that have tolerance for maintaining a solution after adoption.

Example: Supabase has an open-source model paired with paid plans, which has allowed them to penetrate the market quickly.

What to consider when choosing your model, metric, and motion

These choices can get overwhelming, but the great thing is that they can and should change as you build your product and learn more from the market. Very few of them are one way doors.

Every time you think about these decisions, balance them against these dimensions:

What stage of company building are you at? Early-stage startups should opt for simpler models (e.g., tiered or usage-based) to reduce friction and enable experimentation.

Who are you selling to? Developers may prefer transparent, self-serve models. Enterprise buyers often expect sales-led conversations and bespoke pricing.

Who are you competing with? Make a choice to be consistent or materially different based on how competitors price their offerings. Pricing and packaging is a great way to counter-position in a market if you perceive current pricing models as high friction or otherwise not matching the customer persona.