Pricing and packaging is ultimately about psychology. One of our favorite ways of looking at this came from Marco Rivera of Pricing I/O, who said that pricing and packaging form a sort of “exchange rate” that inform perception of value materially.

Pricing and packaging are inter-linked forms of value. Packaging is the value customers get, and pricing is what customers pay for that value. When that exchange rate is out of balance, you’ll feel it in sales friction. When it’s in balance, things are a lot easier and customers are a lot happier.

It’s often a mistake to change pricing without at least slightly modifying packaging – otherwise you risk the perception that customers are paying more for the same thing. The exchange rate, or at least the perception of it, will be out of balance.

In this part of the course, we’ll walk through exercises you can use with your customers to master that exchange rate by designing packaging that’s both intuitive and persuasive.

A couple of notes:

You may have enough information from your pricing conversations to form an opinion about how to package – that’s great, you should trust your gut and revisit this later on.

The earlier you are in business development, the harder it might be to find more folks to interview. You can have this conversation with the same set of participants you had pricing conversations with, or treat this as a separate set of interviews entirely.

Sussing out what features have buying power

One of the most important considerations when designing packaging is to determine what features have buying power versus those that folks expect to receive for free.

There are two ways that build on each other to proxy that type of information and we’ll walk through them below. Together, it should be relatively clear where there’s buying power for different personas.

When you're ready, you can use this template to have this conversation.

Usage value vs. perceived value

The first method is to separate what features have high utility - it’s used all the time - from the features that have high perception of value in the buying process.

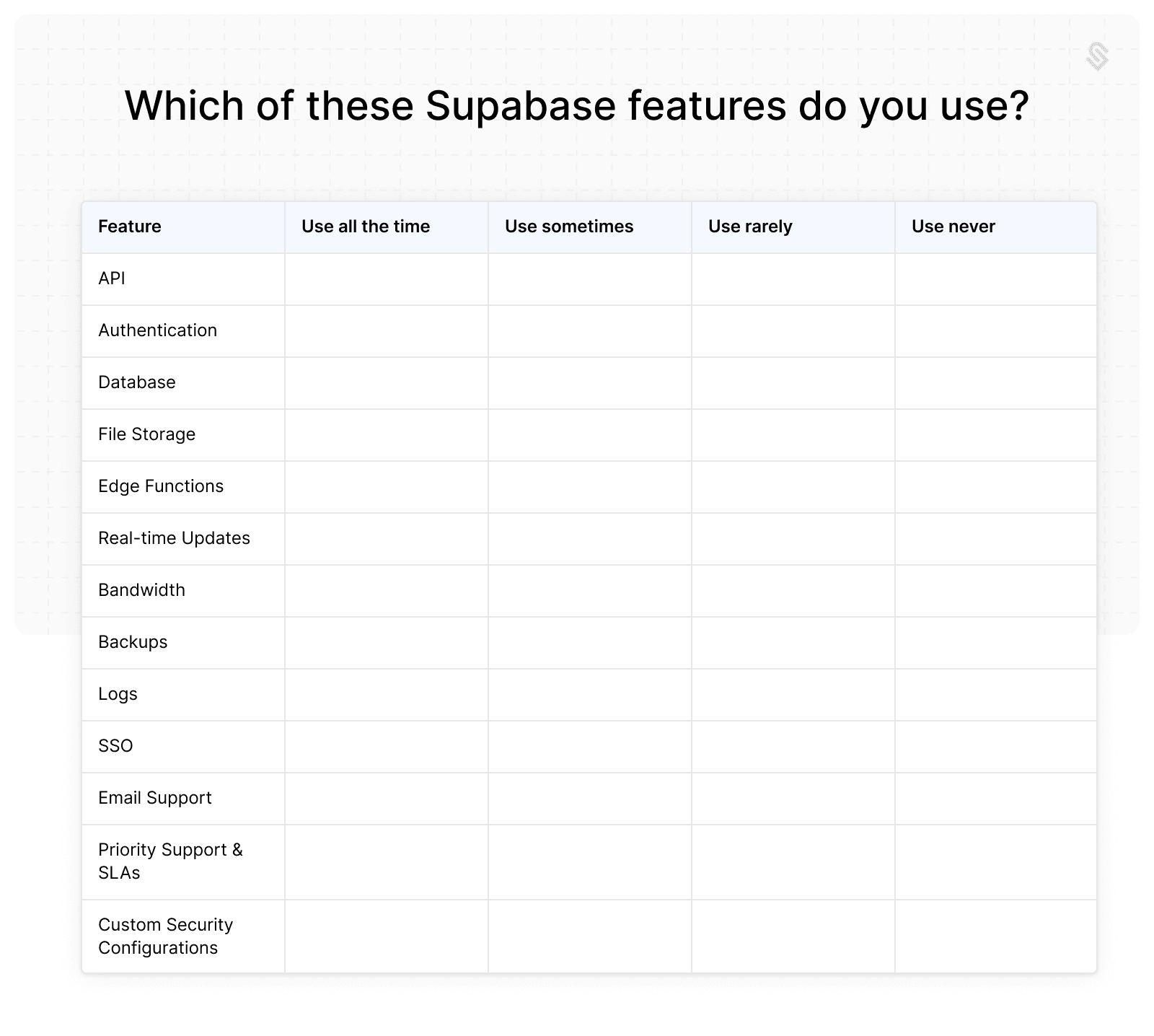

You’ll need two tables for this exercise - each that list out functionality in your product. One table will be used to assess usage value. You’ll ask the interviewee to assign a score to each line, depending on how often they use it.

Importantly, you should include “features” like support and other included services in this matrix. You may be surprised how folks react to them.

Which of these Supabase features do you use?

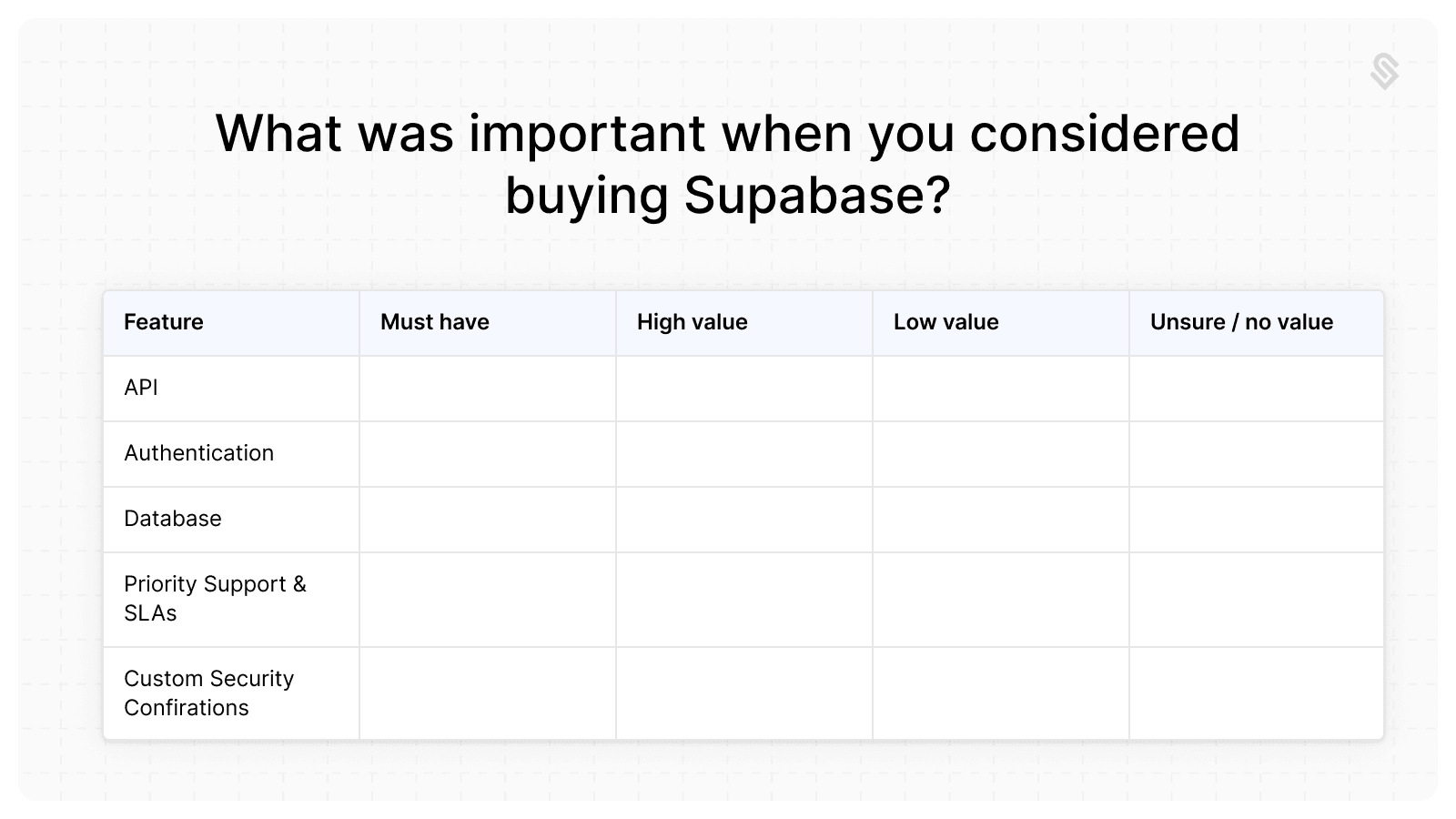

The second table will focus on the same functionality but framed with a question to determine what was important in the buying process.

Similar four dimension scale so you can compare the results from each section.

What was important when you considered buying Supabase? How would you classify each of the following features based on the criteria?

Must have – These are features absolutely necessary in your buying experience.

High value – These features were important in your buying experience.

Low value – These features were not very important in your buying experience.

Unsure / no value – These features were not important in your buying experience, or you did not know they existed.

What you’ll find doing this type of exercise is that there will be many features that are used in a way that correspond to what was important in the buying process. More importantly, you’ll also find features that have low utilization but are extremely important to the buying decision. For instance, Email Support may be a “Use rarely”, but it’s a “Must have” – these are the features that carry unique power.

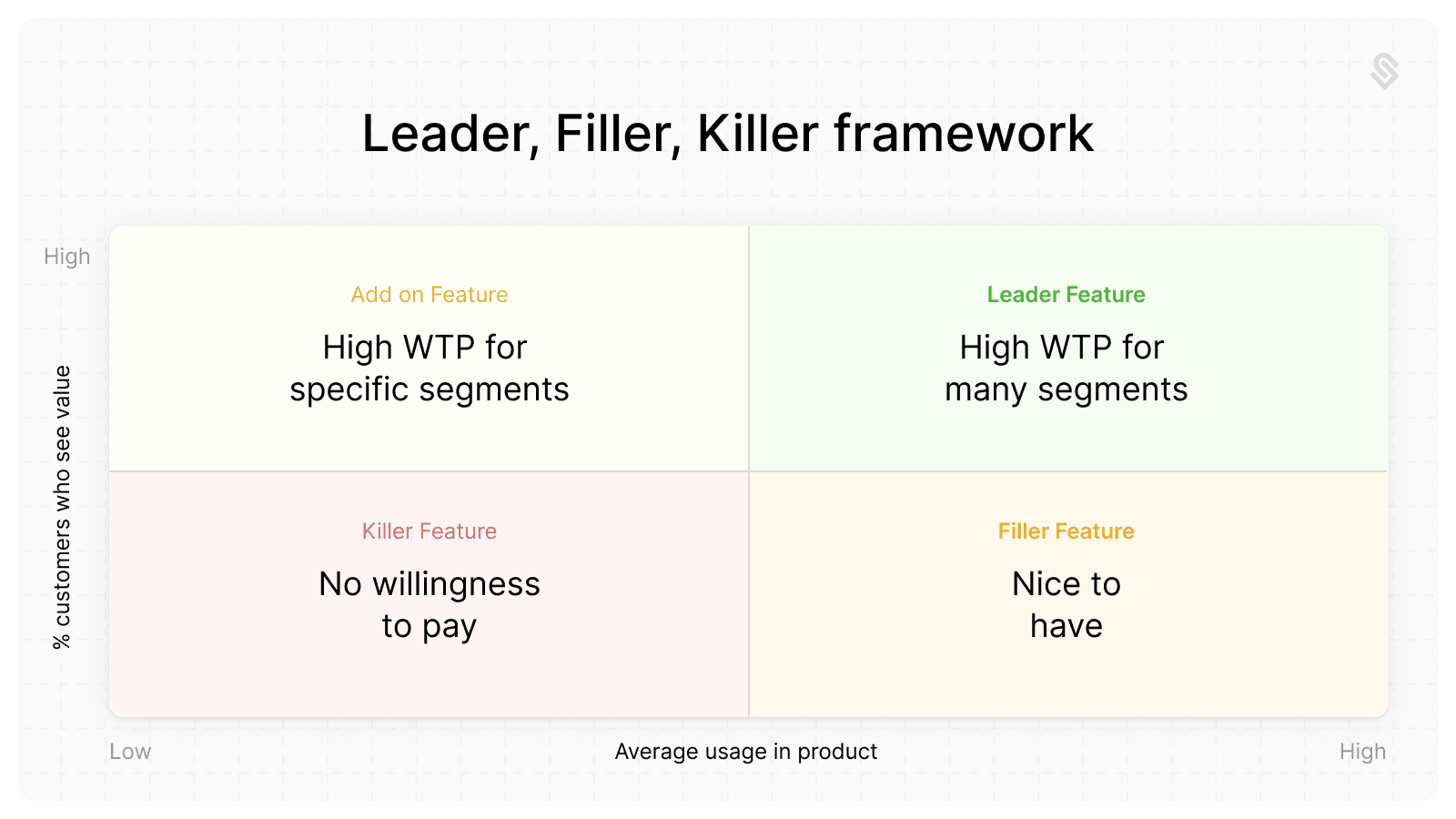

You should take these results across interviews and visualize in a “Leader, FIller, Killer” 2-up.

The "Leader, Filler, Killer" framework

“Leader, Filler, Killer” is a useful way to average your results into an easy to digest format.

The y-axis represents the proportion of folks you interviewed that places high perceived value to the functionality. The x-axis represents the same for utilization.

The result of doing this will be four categories:

Utilization and perceived value are both high = these are leader features – those that your customers are coming to you for and should drive tiering.

Utilization is high, but perceived value is low = these are filler features - table stakes or nice-to-have functionality that folks expect to have. They add utility to each tier, but carry weaker buying power themselves.

Utilization and perceived value are both low = these are killer features - functionality very few are willing to pay for and may de-value the entire bundle. You should consider de-emphasizing or removing entirely.

Utilization is low, but perceived value is high = these are add-on features - those that specific segments are willing to pay for. You should consider making these add-ons.

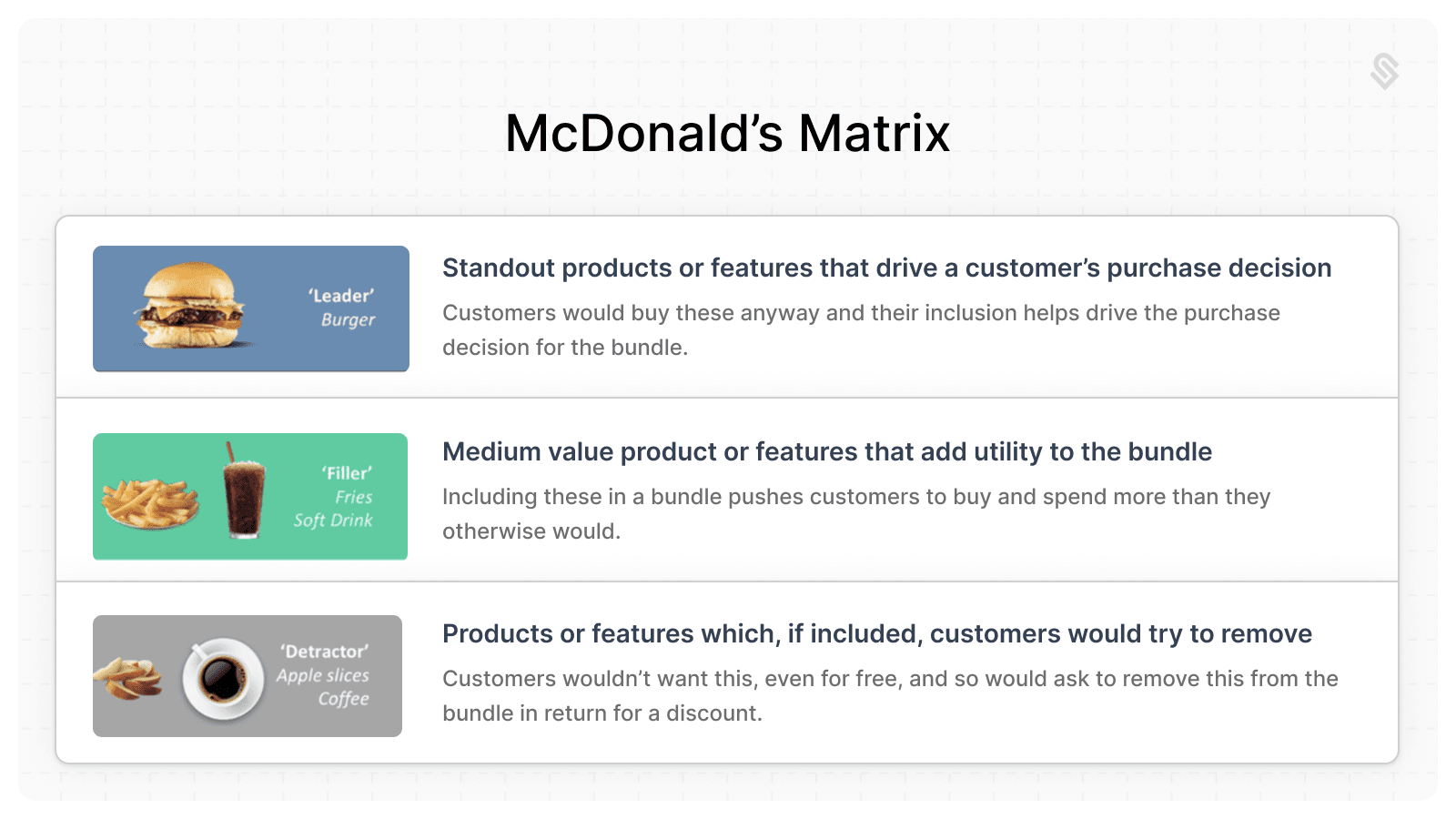

The classic way to see this in action is using a McDonald’s happy meal as an example. The burger is the leader. The coke & fries are the fillers. The side of fruit is the killer.

Layering in customer profiles and segments

Now that you have a read on what features (including future ones!) have buying power for your customers, you’re 80% of the way there.

The last 20%, and arguably the hardest, is separating your market into profiles that might represent use cases. Use cases often line up with company size - the larger a potential buyer, the more complex or comprehensive the use case.

If you feel like you have enough information from your interviews, you can use this exercise to separate folks into natural groups. If not, use your best judgement based on what your product is meant to solve for.

Here’s an example using Supabase. Each tier corresponds to a different use case based on the part of the market they are addressing.

| Free | Pro | Team | Enterprise |

Main differentiator | Ideal for individuals, hobbyists, or early-stage projects with no budget. | Designed for small businesses or indie developers looking for scalability and support. | Tailored for growing companies or startups with compliance and collaboration needs. | Built for large enterprises with high reliability, security, and customization demands. |

Value Prop | Start building with a fully managed backend for free. | Scale your application with more resources and professional support. | Collaborate with your team using advanced compliance and management tools. | Customize your backend for enterprise-grade needs with dedicated support. |

CTA | Get started for free | Try Pro free for 14 days | Contact sales for a demo or trial | Contact sales |

Cost | $0 per month | From $25 per month | From $599 per month | Custom Pricing |

Pain Points | - Limited resources for larger or growing projects. | - Need for scalability and usage-based pricing. - Lack of advanced compliance tools. | - Complex organizational needs requiring SSO, SOC2, or role-based permissions. | - Need for guaranteed uptime, advanced security, and 24×7 support. |

Benefits | - Build, test, and deploy apps quickly. - Free access to core tools. | Everything in Free, plus: - Larger storage and bandwidth limits. - Professional support. - Backups and log retention. | Everything in Pro, plus: - Advanced compliance (SOC2, HIPAA). - SSO for dashboard. - Role-based permissions. | Everything in Team, plus: - 24×7 dedicated support. - Custom SLAs. - On-premise deployment options. |

Internal Story | You are a hobbyist, student, or early-stage developer working on personal or experimental projects. | You are an indie developer or small business looking for scalability without breaking the bank. | You are a growing company with sensitive data and a need for collaboration and compliance tools. | You are a large organization requiring enterprise-grade reliability and customization. |

You can use this template to go through part of this exercise.

Once you have a version you feel is intuitive, layer in features to create a natural upgrade path.

Some things to avoid

Perception of being an overly bloated product

When a product feels bloated, it’s often because too many features are crammed into packages without clear customer value or a use case in mind. When we’re building quickly, we want to appear like we’ve shipped a ton of value, so it’s attractive to list everything.

The truth is some features just don’t matter, and some matter a lot – focus on the ones that matter a lot with the most emphasis. The rest you can list in a feature table for folks that value that detail.

Focus on the most important features that drive value for each use case Identify the top 3 – 5 features that customers would value the most (your leaders, fillers). These anchor your packages.

De-emphasize or cut low value or niche features Killer or add-on features can either be eliminated or offered as optional add-ons for those with specific requirements.

Perception of being an overly complex product

Complicated tiers can confuse customers and slow down decision-making. This happens when you provide too many choices or you’ve not clearly defined why you’ve tiered the way you have.

Simplify choices It’s almost always the right decision to have three to four tiers (Good-Better-Best). It’s intuitive, relatable, and just simple psychologically for buyers.

Clearly communicate value Have a clear use case in mind for each tier. Use clear, plain language that highlight who each tier is for.

Ignoring your competition

Unless you’re in a highly competitive market, this matters less at the early stage because you’re likely creating some differentiated value that has pricing power. However, it’s always a good idea to keep competitors you might be compared against in mind when designing your pricing and packaging.

Importantly, don’t feel compelled to copy them. Frankly, they likely put less thought and rigor into their pricing than you have.

Survey competitors Take a cursory look at competitors pricing pages and try to determine how they arrived where they did. Take the best ideas.

Price within reason You shouldn’t feel pressure to match competitor pricing, but you should be in the same ballpark the closer your solution resembles solutions already in the market.

Not focusing on the customer

There are very likely features that are more costly to deliver to your customers than others. It’s attractive to gate those features in higher tiers because of the cost to deliver them; however, if they are not features your customers are willing to pay for then that may be a poor decision.

When you think about packaging, it doesn’t really matter what costs you money or time to deliver; it matters what your customers value. Hopefully those two things line up!