Pricing doesn’t have to be guesswork — it can be informed and iterative. In part 2, we’ll walk you through a framework to quantify willingness to pay (WTP). By the end of it, you’ll know how to run a structured WTP exercise, using a framework to gather data points and align your pricing with your product’s value.

For early stage companies, it’s not important to be extremely precise here (e.g. $99 vs. $100); it is important to be in the ballpark of what buyers might expect or you’ll insert a ton of friction for yourself.

Why willingness to pay matters

Informed pricing reflects the intersection of customer perception, the value delivered by your product, and competitive positioning. Rather than relying on intuition, understanding WTP lets you make data-informed decisions to maximize revenue and customer satisfaction. This is even more important at the early stage, where weak pricing might slow down your path to PMF.

“Price isn’t just a dollar figure; it’s a direct indication of what the customer wants and values.” (Monetizing Innovation)

Who should you have these conversations with?

If you’re adding rigor to willingness to pay, you very likely have closed a handful of early customers. If you haven’t, you can still use this framework, but it may have lower fidelity.

Before even diving into a framework, though, it’s important to define who you actually care to hear from. Having someone super far outside of your ICP give you insight into how you should price your product’s value is not going to be that helpful.

Instead, target folks that are current customers or potential customers. As much as possible, talk to the buyer rather than the user to have the richest conversation. They should have some sense of the value your product provides to the business, and some awareness of other investments that have been made across the business.

A framework for listening to customers (or potential customers)

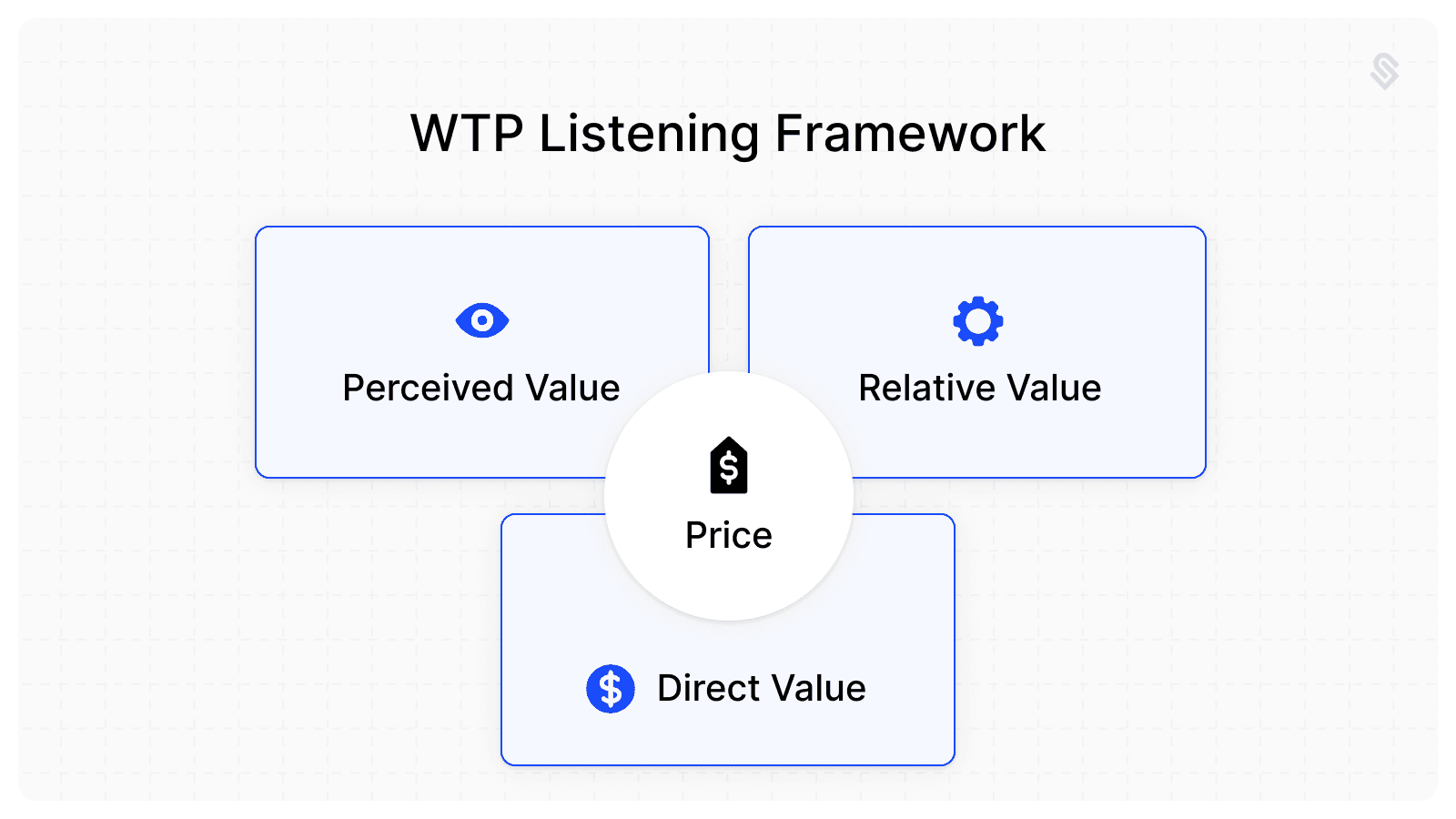

In each conversation you have, you’re ideally getting three pieces of information from the interviewee:

How they perceive the value of your product

How they’d think about the value of your product relative to others they use

What direct value they’d place on your product

Any one of those – perceived value, relative value, direct value – could be wildly off, but together they’ll allow you to proxy a price point that should be close to what you should be charging (especially after a handful of conversations).

Here’s how to have the conversation.

1. Take off your sales hat and create a safe space

Before diving into the interview, lay the groundwork of what you’re doing and why. It’s super important to take off your sales hat & try to create a space that the interviewee feels really comfortable providing their thoughts and opinions.

Here’s one way to do that.

Introduce your product: Highlight key features, unique value, and how it solves customer pain points.

{product} provides a {category of product} product that delivers {value}. With {product} , {user type/persona} can do {X, Y, Z}. It allows users to {X, Y, Z}.

For clarity, list out the unique value props of your product.

If relevant, show them a short, unbiased demo highlighting what it does.

Establish trust: Explain that the goal of the conversation is price discovery.

It’s easy for someone to feel like they are negotiating against themselves in a conversation like this, especially if they are a legitimate prospect or future customer. Put them at ease by suggesting that this doesn’t dictate the specific price they will pay.

Here’s a simple example for Supabase: "Supabase provides a developer-friendly backend platform, delivering managed databases and real-time capabilities for building scalable applications."

2. Dive into perceived value

Use these discovery questions to learn how customers assign value to your product:

“What specific challenges do you think this product could address for you?”

“Which features stand out as particularly valuable?”

“On a scale of 1-5, how likely would you be to buy this product if it were fairly priced?”

There’s some subjectivity here - for example, you haven’t defined what a fair price is - but in this section, you’re leaning on their interpretation of value.

If the interviewee asks for definition, resist the urge to jump in unless there is a complete misunderstanding. Simply ask them to play back their own understanding (e.g. if they are digesting a value prop) or use their own judgement (e.g. if they ask what a fair price is).

3. Triangulate relative value

Relative value is an important signal because you’re proxying off of products that provide tangible value already. Ideally before this conversation, you’ve prepped a list of categories that are either directly related to or tangential to your product. You’ll do two things with that list:

Ask customers to list the tool or set of tools they currently use in that category and the annual cost.

Once the list is filled out, go through each one by one, asking the interviewee to assign a relative value.

“Relative to Firebase, how much value do you think we provide?”

Here’s an example of the start of a table.

Category of tools | Tools | What I pay annually now | {Product’s} relative value as a % |

Database | Firebase | $15,000 | 80% |

Collaboration | Confluence | $25,000 | 60% |

… |

A couple of common questions here:

What if I don’t have direct competitors? Choose categories that provide the value you hope to, either fully or partially.

How many categories should I include? Ideally 3 or more – the goal here is to have a few samples to triangulate.

4. Direct value and the Van Westendorp method

The reason direct value is the last method listed here is because it’s often the trickiest to get a truthful read from folks on. Once you’ve arrived here (and after assessing perceived and relative value), we’ve found that interviewees are primed well to be more open to direct value lines of questioning.

The Van Westendorp method is perhaps the most straightforward way to ask direct value questions and to assess sensitivity. Here are the four questions you should ask:

At what price would you consider the product to be priced so low that you feel that the quality can’t be very good? (Too Cheap)

At what price would you consider this product to be a bargain—a great buy for the money? (Cheap/Good Value)

At what price would you say this product is starting to get expensive—it’s not out of the question, but you’d have to give some thought to buying it? (Expensive/High Side)

At what price would you consider the product to be so expensive that you would not consider buying it? (Too Expensive)

5. Ask for feedback

Make sure you end the interview by asking for open-ended feedback.

Any additional feedback, suggestions, or comments regarding our product, pricing, or anything else.

You might be surprised to not only get great feedback to improve the design of your willingness to pay conversations, but, given you’ve just spent 45-60 minutes talking in depth about the value of the product, you’ll also get spontaneous product feedback (win-win!).

Bonus questions

If you only get through the above in an interview, you’ve already captured enough information to have an informed take on how to price your product. If you have the time and a receptive audience, here are two more questions that would give you even more insight.

1. Identify a price metric

Price metrics are generally associated with the value customers derive from your product. Common examples of price metrics are seats and API calls.

There’s a ton of richness in asking folks in these interviews how they perceive different price metrics. Not only will it allow you to identify a natural expansion lever, but it will also often help you understand roughly how folks see the value they’re extracting from your product, which can inform your product strategy.

Here’s how you do it:

List out possible price metrics that you think might make sense to drive pricing

Ask the interviewee to review the list and choose the most intuitive price metric

Have them describe why that makes sense to them

Then, go one by one through the options they didn’t select, and have them describe why they are less ideal to them

Often, there’s equal or more information in what they did not select versus what they did, so make sure to dig in.

2. Line pricing up with value

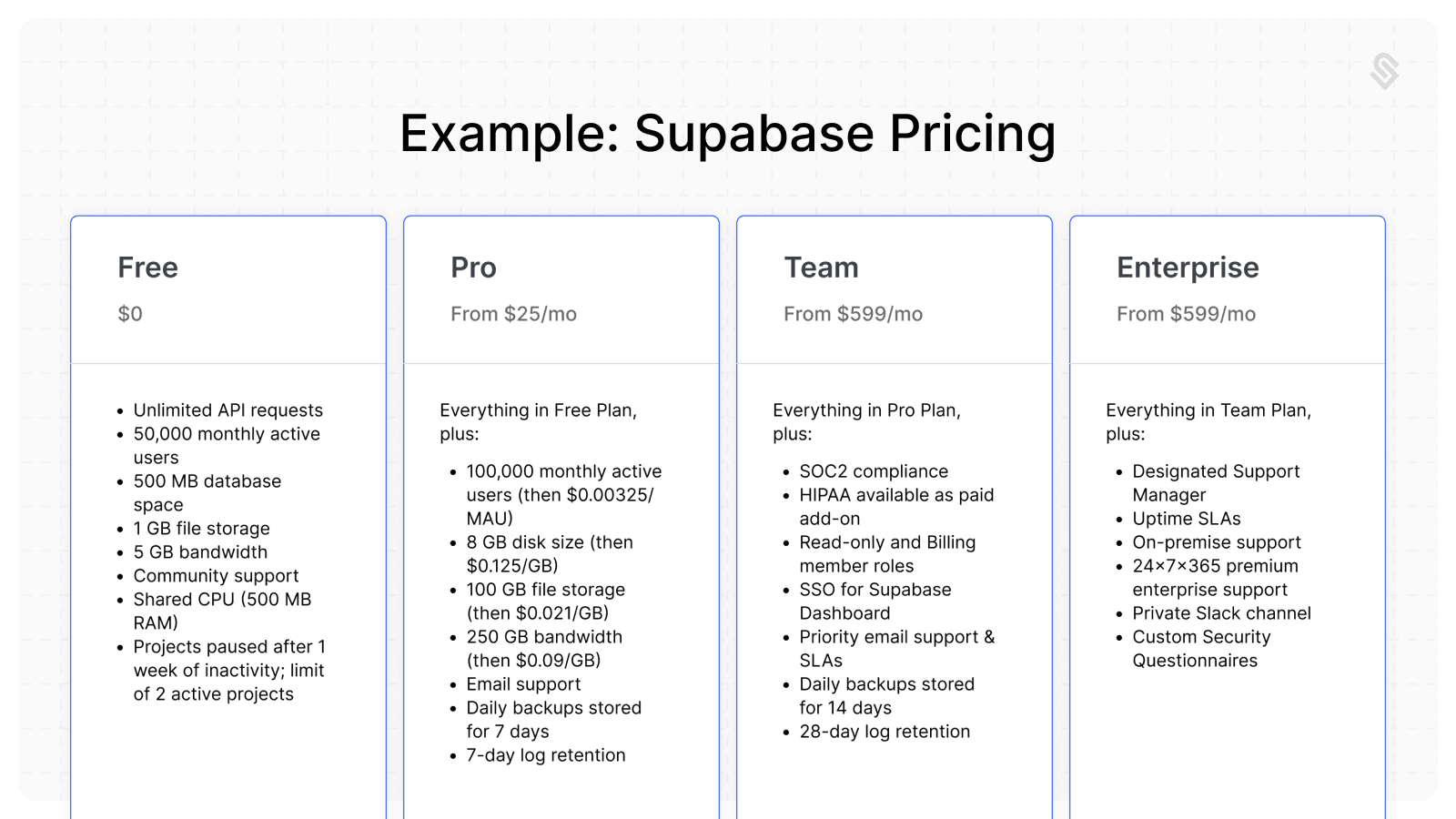

One final step is to have the interviewee review a potential pricing page. Pricing pages are excellent tools for price discovery, because they do two things:

They tell a story of how value should line up to a given price point

They force the viewer to self-select and identify what features actually matter to their use case

You can do this with existing features and features you expect to offer in the future. How this looks will depend on your product, but a simple "Good," "Better," and "Best" system is great for feedback in these conversations.

Once you present the pricing page, ask the interviewee a couple of questions:

What are your reactions?

Please rank the pricing tiers in order of preference from most preferred to least preferred and explain your reasoning.

Here’s an example for Supabase – it’s totally fine if this is not designed and just a simple table (in fact, that may set the right tone given this is discovery):

Willingness to pay template

You can customize this template as a starting place to have WTP conversations, which includes each of the sections described above.