Pricing and packaging are among the most critical — but often overlooked — levers for achieving product-market fit (PMF) and scaling a SaaS business.

However, we often do two things when it comes to pricing and packaging that make our lives harder:

We delay thinking about it for too long, and while we may have created a great product, we haven’t created a great business

We overcomplicate pricing and packaging discovery, which leads to too high of a bar to iterate

Van Westendoorp, MaxDiff, and conjoint analyses all have their places, I promise, but they are just a means to an end: to determine what your customers are willing to pay & to capture value as quickly as possible for the services you’re offering.

The best companies optimize their pricing and packaging every three months. That doesn’t mean going through price discovery every quarter, but that does mean introducing new features that might change the profile of your packaging (e.g. bundle changes, add-ons, etc.), targeting new market segments, and/or, of course, moving the price point in response to the market.

And it might actually be much faster at the early stage because you’re shipping and learning so quickly.

By breaking pricing and packaging down into actionable concepts, we hope we can help founders align value creation with value capture faster, with more confidence, and more often.

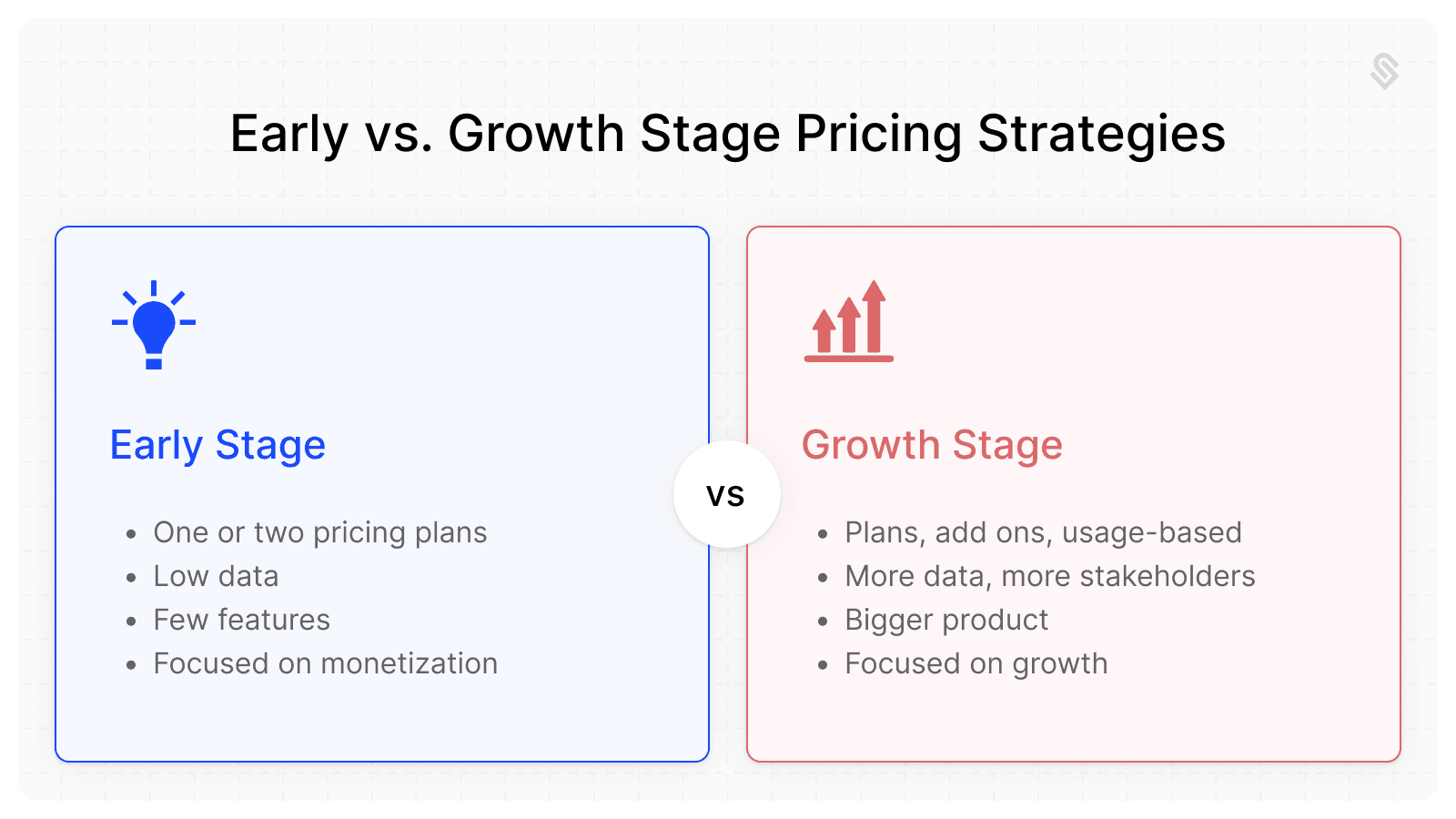

How Pricing and Packaging Differs at the Growth Stage vs. the Early Stage

This course will focus on early stage pricing and packaging because we believe the practice is materially different as your company grows. The challenges of initially defining pricing and packaging are unique, and we’ll help you navigate those.

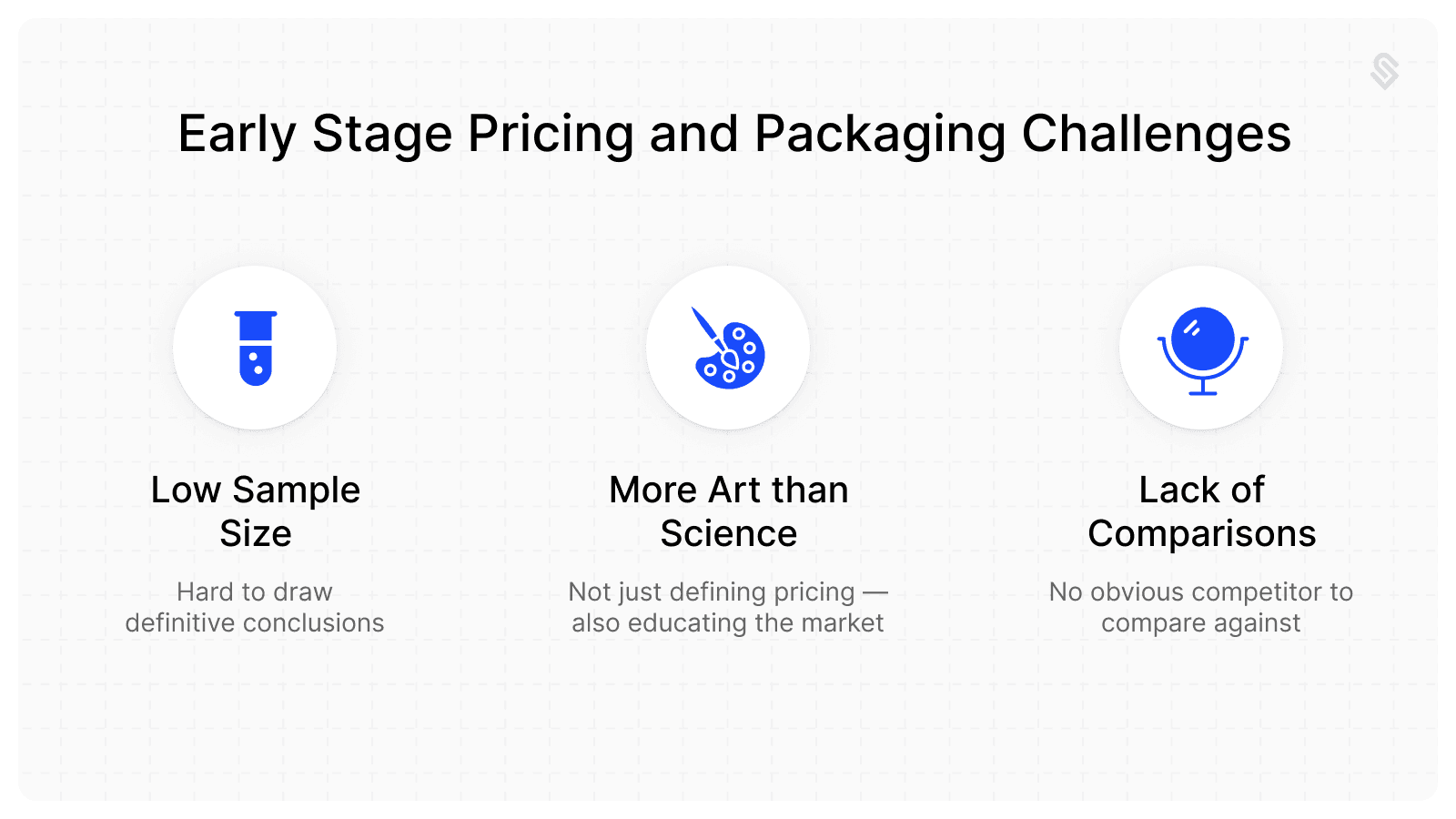

Among those challenges are:

Low sample size - You’re likely working with a relatively small customer base, which means your data points are limited. It’s hard to draw definitive conclusions about what customers do or do not value with any significance.

More art than science - Your category may be nascent and lack the clarity that established players can provide as a counterpoint. You’re not just defining pricing — you’re also educating the market about how they should value a product like yours.

Lack of comparisons - Because you might be solving for a problem that hasn’t been fully addressed before, there’s no obvious competitor to compare against. There are tangential players to proxy against, but you’re essentially writing the rules as you go.

You’ll have to listen to two voices: what your existing customers are saying, and your own gut instincts about how you want the market to receive a solution like this. We’ll primarily cover the former here - how to listen to your customers to get the highest signal to pair with your own gut instinct.

At the early stage, pricing and packaging should optimize for:

Learning over perfection: Pricing serves as a tool for accelerating PMF.

Simplicity: Customers and early stage businesses benefit from easy-to-understand pricing models.

Customer alignment: Every pricing conversation is an opportunity to learn about what your customers value.

At the growth stage, everything changes. There will be more data, more stakeholders, and many more systems to ensure interoperability between. The customer-centric approach that is paramount at the early stage has to be balanced with more defined optimization goals and harder internal constraints.

Examples of Great Pricing and Packaging from Startups

These types of sections are always challenging for a couple of reasons.

First, pricing and packaging changes all the time, so the snapshot below is very likely not what is live on the site right now.

Second, it’s arguable what an “early stage” startup is. Both examples have demonstrated PMF, so are definitely past the early customer days. Still, the choices they’ve made are instructive.

Example 1: Mintlify

Mintlify is a documentation provider that initially entered the market as a developer-first tool that not only structured docs, but also auto-generated API references.

They started in 2022, and they are already a popular choice in the market. Their primary competition are from homegrown builds and incumbents that include Readme and Scalar.

Their pricing is relatively straightforward, and they’ve evolved it quite a bit in the last two years. What you’ll notice if you go through the purchasing process is that they do quite a good job with initial conversion, most likely because their product has a high barrier to exit.

What do they do really well?

They give away a lot of value in their free tier, which greases the wheels to acquire a lot of early stage companies and indie hackers. This also aligns really well with their initial target persona (developers).

They price relatively similarly to competitors, making the distinction come down to brand and feature set.

They tier their product based on company type, making it clear how to self select based on your stage (e.g. if you’re a scaled company, you likely value advanced security)

They don’t overcomplicate pricing with a complex or novel value metric.

Where might they have an opportunity?

While the pricing is simple, there’s not great expansion potential beyond the number of editors (they do have add ons, as well, which may be a larger part of their model moving forward)

Example 2: Pylon

Pylon is a support CRM that is specifically built for B2B companies. They compete in a market that has historically been dominated by Salesforce and Zendesk.

They started in 2023 and have enjoyed quite a bit of success with high growth startups looking for a modern support system.

Their pricing is seat based and that unit carries a premium in higher tiers as more features are unlocked.

What do they do really well?

They don’t rock the boat with pricing - competitors in this space use a similar value metric, seats, so they have, too.

They’ve made a choice to be entirely sales-led – they offer no free tier and require a demo to dissuade tire kickers or non-serious businesses.

They’ve found feature levers / category levers that customers put a premium on

For instance, automation and integrations categorically are clear value drivers into Professional. Security, reliability, and control are clear value drivers into Enterprise.

Where might they have an opportunity?

Given their focus on B2B companies, they could capture more downmarket mindshare with a pared down free tier; however, it’s unclear if that customer population matters to them strategically.

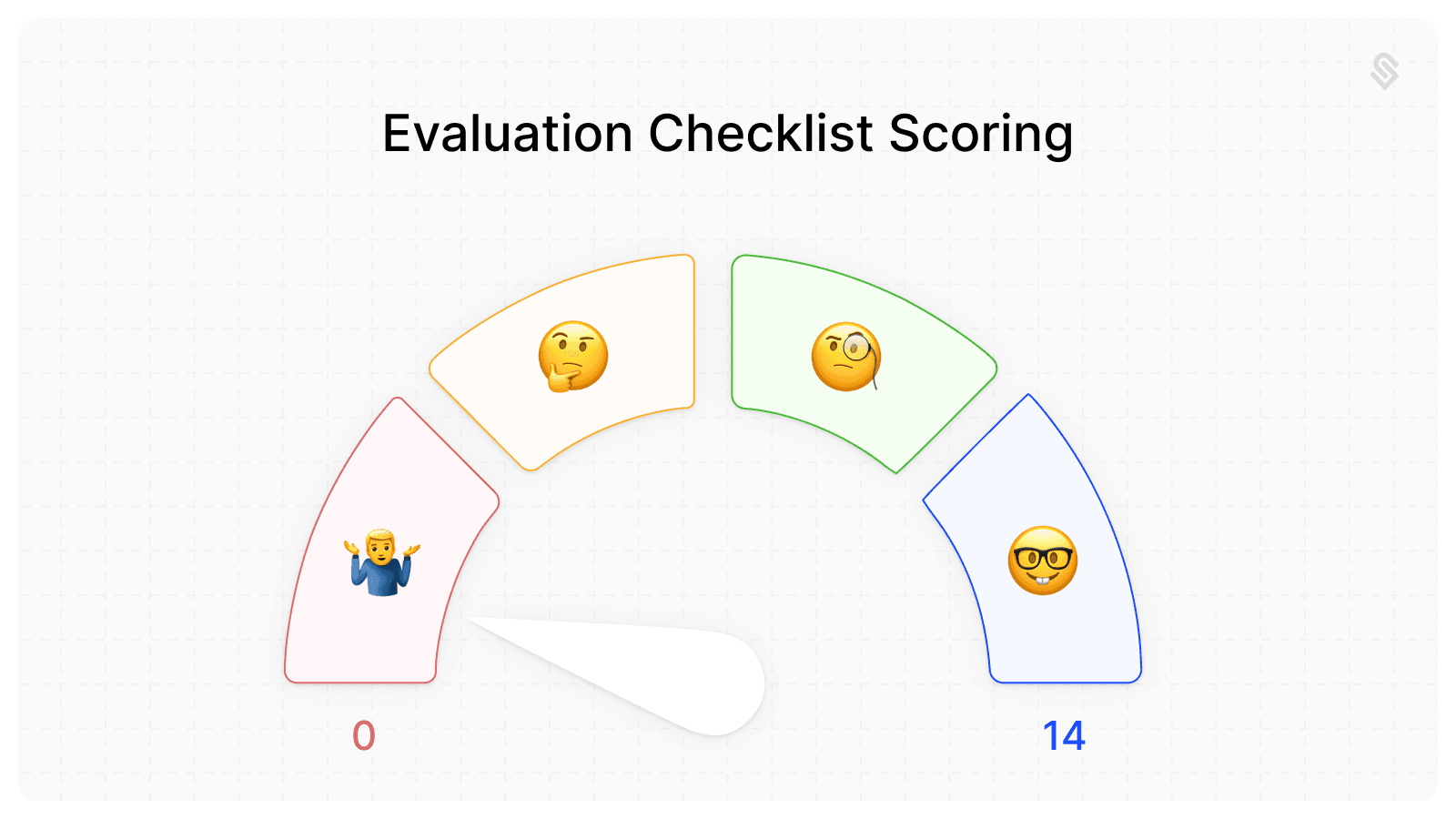

Checklist for evaluating your current pricing and packaging

Here's a link to the survey. Score each question from 0-2 (0 = not at all, 2 = absolutely):

Is your pricing aligned with the value your product delivers?

Does your pricing model reflect your core value metric (e.g., usage, seats, features)?

Does your packaging offer clear, distinct options that match current or potential customer needs?

Does your pricing scale as customers grow?

Is your pricing intuitive and easy to understand at a glance?

Have you tested your pricing with real customers and adjusted based on feedback?

Do you revisit your pricing at least every 6 months?

Total Score:

0-5: Your pricing and packaging needs some love.

6-10: You have a solid foundation, but there’s definitely room for improvement.

10-14: Good stuff!

What’s next

Over the course of the next few lessons, we’ll break down how to listen to your customers and how to pull what you hear together to inform your pricing model. That includes having conversations about packaging, having conversations about pricing, and picking a value metric!