Zuora is a widely used subscription billing platform. It supports complex billing scenarios, revenue management, and global compliance. For many teams, it becomes the default billing solution early on.

Over time, some product and pricing teams outgrow that model. You introduce usage billing, custom pricing models, and sales-led overrides. Access decisions move closer to runtime. Billing data alone no longer reflects what customers should see or use.

That shift forces hard decisions. Billing systems focus on invoices and payments. Engineers end up hardcoding pricing logic. Product teams lose control over how plans and entitlements behave inside the application.

All of this leads teams to search for Zuora alternatives. Not all options solve the same problem — some focus on replacing billing volume and invoice automation, some complement billing by managing subscription state and enforcing access in the product.

This article compares the best Zuora alternatives in 2026.

These are the top Zuora alternatives in 2026:

Stripe Billing

Chargebee

Recurly

Paddle

Maxio

Metronome

Lago

Zuora is a subscription billing and recurring billing platform designed to help B2B SaaS companies manage billing operations at scale.

Teams use it to manage subscriptions, run billing cycles, and support billing and revenue recognition through the full subscription lifecycle.

The platform focuses on finance and operations workflows. It supports invoice automation, payment processing, and payment collection through multiple payment processors and payment gateways.

Zuora also handles global billing, including multi-currency billing and global tax compliance, which helps when SaaS companies sell in multiple regions.

Zuora works well for complex billing models that rely on tiered pricing, custom pricing models, and predictable recurring revenue models.

Finance teams use it to track billing data, monitor failed payments, and report on revenue trends using built-in reporting capabilities.

As teams adopt usage-based billing, hybrid pricing, and higher billing volume, traditional billing infrastructure starts to show its limits.

Pricing changes rarely stay inside a billing tool. You add usage‑based pricing, tiered pricing, or prepaid credits, then discover pricing logic spread between application code, Zuora billing rules, and internal documentation.

Engineering ends up owning complex billing logic just to support everyday changes, because Zuora’s configuration can be cumbersome and often requires custom fields, workflows, or integrations to model new pricing schemes.

Ownership friction grows as products scale. Finance and ops teams manage invoices and complex revenue recognition in Zuora, while product teams need plans, limits, and trials enforced inside the app.

That split creates gaps between Zuora’s billing automation and how customers actually experience access.

As pricing models change, this gap appears more often. According to OpenView’s State of Usage-Based Pricing report, three out of five SaaS companies now use some form of usage-based pricing, with many adopting hybrid models that combine subscriptions and usage.

Hybrid GTM adds pressure. Self‑serve flows rely on flexible billing models and metered billing, while sales pushes custom contracts that Zuora often treats as exceptions, requiring manual overrides or custom configuration.

Subscription state fragments between Zuora, portals, CRM, and ERP systems.

Payment complexity raises operational costs. Global billing and multi‑gateway setups in Zuora add coordination overhead without improving runtime product control over pricing or entitlements.

Teams start looking for Zuora alternatives when basic subscription management no longer supports hybrid pricing, runtime access decisions, and in‑product enforcement.

Zuora is not the only way to manage subscriptions and billing at scale. Teams evaluate alternatives based on what they need to control between billing, pricing, and product behavior.

Some tools focus on billing execution and revenue reporting. Others support usage-based pricing or global payments. A smaller set connects pricing rules to how products behave.

The tools below are the most common Zuora alternatives in 2026.

Schematic is a monetization control layer for SaaS and AI products. You use it to define plans, entitlements, limits, trials, credits, add-ons, and exceptions in one system of record, then enforce those rules inside your product at runtime.

It’s built on Stripe. Teams that want to move pricing and entitlement logic out of billing-first platforms like Zuora often pick Schematic when billing alone cannot express how access should work in the app.

Schematic helps in the revenue moments that tend to break billing-first setups. A trial ends, and the product needs to downgrade access immediately.

Usage approaches a defined limit, and teams want to trigger downstream workflows before overages apply. A customer on a custom contract needs a temporary exception with a clear expiration.

These cases show up quickly once you run hybrid pricing across self-serve and sales-led motion.

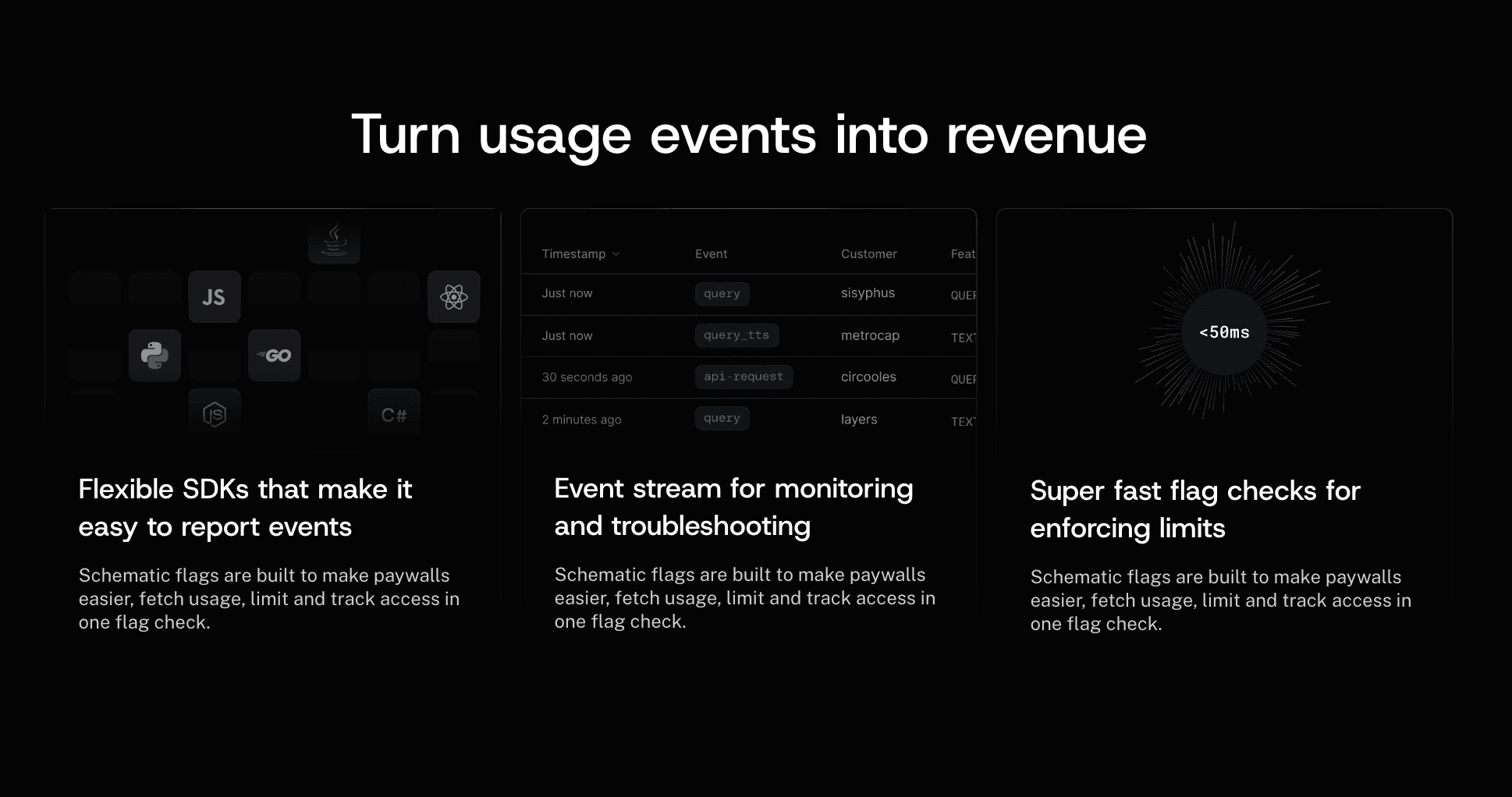

Central catalog for plans, entitlements, limits, trials, credits, add-ons, and exceptions

Runtime enforcement for feature access and usage limits, not just invoicing logic

Usage tracking that supports seats, API calls, tokens, credits, or any event metric

Company-level overrides for enterprise deals with expiration dates and audit history

Stripe sync to align billing state with product access without copying objects

Embedded billing UI components for upgrades, downgrades, and customer self-serve flows

Sub-50ms evaluation to support frequent checks in production

Starter – Free. Includes 10 subscriptions, 2 company overrides, 500,000 events per month, unlimited flags, Stripe integration, and more.

Growth – $200/month. Includes everything in Starter, plus 100 subscriptions, 20 company overrides, 10,000,000 events per month, trials, usage based add ons, and more.

Enterprise – Custom. Includes everything in Growth, plus unlimited subscriptions, unlimited company overrides, unlimited events, unlimited webhooks, premium support, data exports, and more.

Add-on: Teams – $500/month. Includes unlimited company overrides and unlimited webhooks.

Source: stripe.com/billing

Stripe Billing is a developer-focused billing layer built on Stripe’s payments stack. Teams often evaluate it as a Zuora alternative when they want direct control over subscription management without adopting a full enterprise revenue platform.

It supports subscriptions, metered usage, and custom checkout flows that integrate tightly with internal systems.

Compared to Zuora, Stripe Billing trades packaged revenue workflows for flexibility in code, similar in scope to tools that mirror Zoho Billing pricing or compete with Salesforce Revenue Cloud at the infrastructure layer.

Stripe Billing fits engineering-led teams that prefer building pricing enforcement rather than configuring it.

Usage-based and subscription billing

Native Stripe Payments integration

Flexible pricing configuration

Developer-first APIs

Global payment support

Pay-as-you-go – 0.7% of billing volume. No recurring fee. Suited for variable or early-stage usage.

Monthly contract – From $620/month. Includes a billing volume allowance with lower effective rates at scale.

Source: chargebee.com

Chargebee is a subscription billing and invoicing platform designed for SaaS teams that need structured control over recurring revenue.

It is often evaluated as a more accessible alternative to Zuora for teams that want billing capabilities without the setup and admin overhead of large enterprise platforms.

You can use it to manage plans, billing cycles, invoices, taxes, and revenue recognition from a finance-first system.

Chargebee supports hybrid pricing patterns such as subscriptions with add-ons and usage-based billing, but product access and enforcement usually live outside the billing layer.

Teams choose Chargebee when finance needs a billing system for invoices, taxes, and revenue recognition, without the overhead of a larger enterprise platform. It integrates with Stripe and other payment gateways to support global customers.

Chargebee fits organizations where finance and RevOps own billing operations and pricing changes follow defined workflows, similar to Zuora, but with a lighter setup and faster adoption curve.

Product teams typically implement access rules separately when plans, limits, or trials need to affect behavior inside the app.

Subscription billing and invoicing

Payment processing and tax handling

Revenue recognition workflows

Dunning and retry logic

Finance and RevOps integrations

Starter – $0/month. Free for the first USD 250K in cumulative billing, then 0.75% on billing.

Performance – USD 7,188/year (billed monthly). Supports up to USD 100K billing per month.

Enterprise – Custom pricing for larger billing volume and advanced needs.

Source: recurly.com

Recurly is a subscription billing platform often evaluated as a Zuora alternative by teams that prioritize payment reliability and high transaction volume over pricing flexibility.

You use it to manage subscriptions, automate recurring billing, and handle renewals on predictable billing cycles.

Compared to Zuora, Recurly focuses on operational simplicity and retention workflows rather than complex contract modeling. Teams adopt it when pricing stays standardized, and contracts follow consistent terms.

Recurly fits teams that prioritize payment recovery and retention workflows over complex contract modeling, while finance teams rely on its reporting for subscription performance.

Recurly does not control in-product access or runtime enforcement. Product teams usually manage entitlements, limits, and trials outside the billing system when those rules need to affect user behavior.

Subscription lifecycle management

Automated recurring billing

Churn and retention tooling

Payment optimization and retries

Subscription analytics and reporting

Subscriptions – Custom pricing. Based on Total Payment Volume, with a minimum threshold.

Source: paddle.com

Paddle approaches subscription management through a merchant-of-record model.

Instead of acting purely as billing infrastructure like Zuora, Paddle becomes the legal seller and takes responsibility for payments, taxes, and compliance. This shifts operational burden away from internal finance and legal teams.

Teams use Paddle when selling software globally and needing built-in handling for VAT, sales tax, and cross-border payments.

The platform manages checkout, subscriptions, invoicing, and revenue reporting in one system. This setup reduces the need to integrate separate tax engines or payment providers.

Paddle focuses on financial execution rather than in-product pricing control. Feature access, entitlements, limits, and runtime enforcement remain outside the platform.

Compared to Zuora, Paddle trades configurability and internal control for simplicity and compliance coverage.

It fits SaaS companies prioritizing international expansion and reduced operational ownership over fine-grained pricing logic inside the product.

Merchant-of-record billing and payments

Subscription billing and invoicing

Global tax and compliance handling

Checkout and payment processing

Revenue reporting and payouts

Pay-as-you-go – 5% + $0.50 per transaction. Covers payments, billing, and tax compliance.

Custom pricing – Contracted rates for higher volume or complex business models.

Source: maxio.com

Maxio focuses on subscription billing combined with financial reporting and SaaS metrics. Finance teams use it to manage invoicing, revenue recognition, and MRR through the customer lifecycle.

Compared to Zuora, Maxio emphasizes reporting clarity and accounting alignment over complex billing configuration.

The platform supports recurring billing, collections, and revenue schedules, then surfaces that data through standardized financial reports.

Maxio fits finance-led teams that want clean revenue reporting and accounting alignment, not in-product entitlement enforcement. It also does not enforce in-product access or usage limits at runtime.

Product teams usually manage entitlements, limits, trials, and upgrades outside the billing system. Maxio acts as a financial system of record rather than a product control layer.

It fits organizations where finance owns billing workflows, audits drive requirements, and pricing changes follow structured internal processes rather than real-time product enforcement.

Subscription billing and invoicing

Revenue recognition support

SaaS metrics and reporting

Financial analytics

Accounting integrations

Grow – $599/month. Supports billing up to defined monthly volume with standard reporting.

Scale – Custom. Adds advanced revenue management and higher billing limits.

Source: metronome.com

Metronome, now part of Stripe, provides usage-based billing and real-time metering for products where pricing depends on consumption.

Teams evaluate it when they already rely on Stripe and need more advanced usage rating and billing primitives than Stripe Billing alone provides.

The platform focuses on collecting usage data, rating events, and generating invoices that reflect actual activity. It fits products with variable usage patterns that extend beyond standard subscription billing.

Metronome handles billing calculation rather than subscription management or in-product access control.

Finance teams typically own Metronome for invoicing and revenue workflows. Product teams manage plans, limits, trials, and entitlements in application code or separate systems. Runtime enforcement and feature access remain outside the billing layer.

Metronome replaces parts of billing stacks where Zuora-style configurations become difficult to maintain. It does not act as a product control or monetization enforcement system.

Usage-based and metered billing

Real-time usage tracking

Flexible pricing configuration

Invoice generation

Finance-focused reporting

Starter – Entry plan for launching usage-based products with real-time event ingestion and Stripe integration.

Custom – Designed for high-volume usage, complex pricing models, and enterprise revenue workflows.

Source: getlago.com

Lago is an open-source billing platform built for SaaS teams that need subscription billing and usage-based billing without adopting a heavy enterprise system like Zuora.

Engineering-led teams use Lago when they want direct control over billing logic, data flows, and infrastructure ownership.

The platform supports subscriptions, metered usage, and custom pricing logic through an API-first and modular architecture.

Lago handles usage calculation, rating, and invoicing, while product access, entitlements, limits, and runtime enforcement remain inside your application. It provides billing primitives rather than opinionated workflows.

Lago fits teams that want flexibility similar to building in-house billing, but with a maintained open-source foundation.

It requires engineering ownership to operate, scale, and maintain reliably, especially as billing volume grows or pricing models evolve.

Open-source billing platform

Subscription and usage billing

Flexible pricing logic

API-first design

Modular billing infrastructure

Business – Custom pricing. Core Lago platform with usage calculation, invoicing, integrations, and standard support.

Enterprise – Custom pricing. Includes Business features plus advanced support, deployment options, and scaling assistance.

Choosing a Zuora alternative depends on where your complex billing needs show up and who owns them.

Some teams want a financial operations platform that improves invoicing, payments, and reporting. Others need control over how pricing rules affect access inside the product.

Start with your GTM motion. Hybrid pricing and hybrid selling create pressure that flexible pricing models and complex pricing models must support without slowing teams down.

Sales-driven custom contracts often collide with self-serve flows when subscription state lives only in billing tools.

Ownership shapes how teams operate. Finance and ops teams optimize payments, taxes, and reconciliation through global payment methods and multiple payment gateways.

Product teams care about limits, trials, and add-ons enforced at runtime. Mixing those concerns in one system often creates a steep learning curve and fragile workflows.

The right alternative separates billing execution from product control. Look for clear key features like subscription management, predictable cost structure, and an intuitive interface that supports growth without becoming another constraint.

Billing systems record what customers should be charged. They do not decide what happens inside the product when conditions change.

That limitation shows up quickly once pricing moves beyond simple plans.

Usage crosses a limit mid-cycle. A trial expires while a user stays logged in. Sales grants an exception that billing reflects, but the product does not.

Teams then rely on manual checks, delayed updates, or one-off fixes that do not scale.

Hybrid pricing and hybrid selling make the problem harder. Self-serve customers expect clear limits and upgrades. Sales-led accounts expect overrides, add-ons, and exceptions to be honored immediately.

Billing data updates after the fact, but product teams need access decisions enforced at runtime.

That tension grows when subscription state spreads between billing tools, CRM systems, and revenue platforms.

Even with advanced features, billing tools stay finance-first by design.

At that point, teams look for a more cost-effective way to control access, limits, and entitlements directly in the product, without tying every decision to an invoice.

Zuora works when billing is the primary system of record. That model breaks down once pricing decisions need to affect product behavior in real time. Usage limits, trials, credits, add-ons, and contract exceptions cannot wait for invoices to post or billing cycles to close.

Most Zuora alternatives improve one part of the stack — invoicing and payments, high-volume usage billing, how pricing rules translate into access inside the product.

Schematic stands apart because it treats monetization as product infrastructure. It defines plans and entitlements once, then enforces them at runtime for both self-serve and sales-led flows.

Engineering stops rebuilding billing logic. Product teams regain control over how pricing behaves in the app. Finance keeps billing in Stripe without duplication.

Zuora’s competitors include billing and subscription management platforms such as Chargebee, Recurly, Stripe Billing, Paddle, Maxio, Metronome, and Lago. Teams also evaluate monetization control layers like Schematic when billing systems alone cannot manage in-product access, usage limits, or contract exceptions.

As of now, Zuora has not announced an acquisition and continues to operate as an independent company. Any future acquisition activity would be disclosed through official company or regulatory announcements.

Zuora offers Zuora CPQ, a quoting system purpose-built for subscription lifecycles, including renewals and usage pricing. While its core platform focuses on billing and revenue recognition, CPQ handles sales configuration and integrates with it. It complements standalone CPQ tools but specializes in recurring models.

Yes, Zuora is a HIPAA-compliant platform.