Ask any modern SaaS team and they’ll tell you the same story: the clean separation between PLG and traditional sales is gone. Customers don’t progress through a tidy, linear pipeline anymore. They start with the product, form their own opinions, test their own use cases, and only after proving value to themselves do they want to talk about contracts and pricing. Traditional sales models, which relied on face-to-face interactions and localized efforts, are increasingly being replaced by hybrid and product-led approaches that leverage digital channels and self-serve experiences.

The product now opens the door. Sales turns proven usage into real revenue. Product led go-to-market strategies focus on customer acquisition and retention through direct product interaction, while sales led strategies emphasize personal relationships and targeted outreach, each with distinct advantages and challenges. And the order of operations has quietly, but massively, shifted. Most customers don’t want a pitch before they’ve had a chance to try something. They want to read your docs, run a POC, wire up an endpoint, and validate that the product works in their world. Only then are they ready for a commercial conversation.

This new sequence is changing how companies identify qualified accounts, how they structure pricing tiers, and how they run their go-to-market motions. For a SaaS business, adapting the sales model to blend product led and sales led strategies is now essential for scaling and sustaining growth.

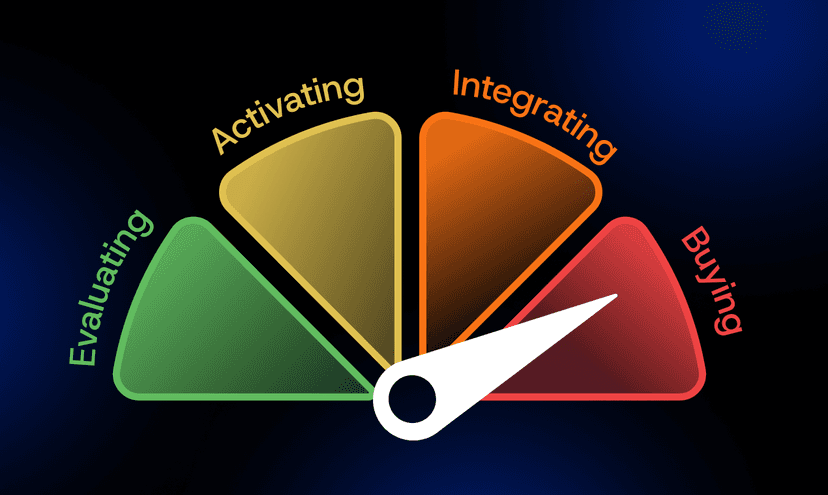

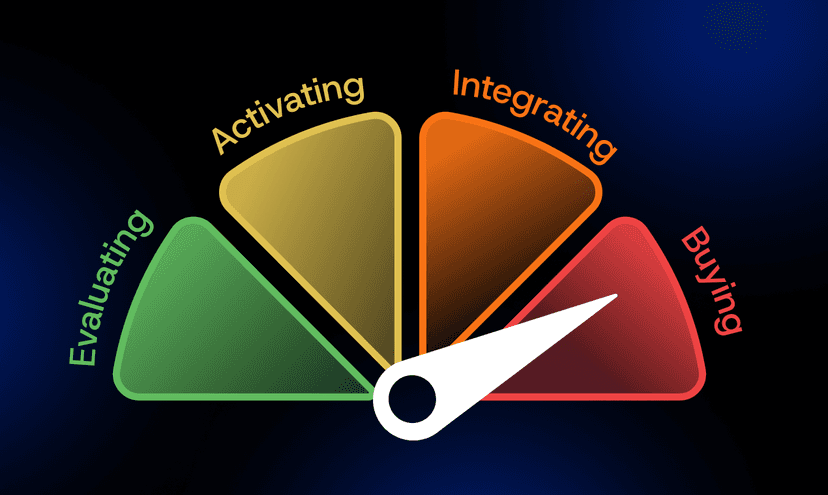

When we talk about hybrid sales, we’re describing a go-to-market model where product-led adoption and traditional sales motions work together rather than in isolation. The customer’s journey doesn’t start with a demo request or a cold outbound email. It starts with the product itself. Individuals or small teams try the product on their own, form opinions, build early prototypes, and validate whether it actually fits their needs.

Only after that product activity creates clear signals — real usage, internal advocacy, signs of a meaningful use case — does the sales team step in. And when they do, the conversation is very different from a conventional top-down sale. Sales isn’t introducing the product or shaping the problem. They’re helping the customer formalize something that’s already working: figuring out the right plan, the right pricing structure, the right level of predictability or support.

In the old model, a salesperson decided whether a customer was worth pursuing. In the modern model, the product itself makes that determination. When someone invests real time into trying your product, such as wiring it into a workflow, testing it under load, or using it in a small team, that behavior tells you far more than any lead score.

Starting an enterprise sale with product qualification works because it's “aligned with value and actually useful to the end customer," says Fynn Glover at theSchematic Monetizing AI Summit. "The customer isn’t being asked to imagine what the product might do for them. They have already seen it work." By the time a salesperson enters the process, the question is rarely 'Does this solve a problem?' and more often 'What’s the right way for us to use this going forward?'

Only then does the sales conversation begin. And at that point, the dynamic is very different from a traditional top-down sale. Sales isn’t educating or persuading from a blank slate. They’re joining a customer who already has context, opinions, and a mental model for where the product fits.

This shift has made product usage a far more trustworthy qualification mechanism than any traditional attribute. There’s simply no substitute for someone choosing to spend time with the product. Today, providing insights from product usage data is more valuable than traditional lead scoring, as it enables businesses to make informed decisions and optimize their SaaS sales strategies.

"That’s why pricing and packaging is so important — you're often orienting your pricing and packaging to different segments of the market or different customer types." -- Fynn Glover

None of this works without pricing that supports both sides of the journey.

A low-friction entry point is what allows a PLG motion to exist in the first place. If the early experience requires a contract, a demo, or a multi-step onboarding process, you’ve already lost the thread. A reasonable starter plan gives people space to explore without needing to justify that exploration internally.

But pricing also has to create natural transition points. Most companies discover a small set of meaningful inflection moments: when a team hits a usage limit, or starts adopting high-value features, or begins wiring the product into production systems. These moments are often the first signs that the customer has outgrown the starter plan. Good pricing doesn’t just collect revenue at those points, it reveals that the customer is moving from experimentation into something more committed.

On the other end of the spectrum, enterprise buying requires predictability. Annual commitments, budget ranges, deployment considerations all matter once the product moves from “interesting” to “important.” The challenge for hybrid GTM is that the same pricing model must serve individuals exploring in a sandbox and companies operating at scale. When pricing is too rigid, one side of that equation breaks.

What emerges is effectively two funnels stacked on top of each other. Mapping the customer journey across both funnels is essential to ensure a seamless and integrated experience for customers as they move between digital and in-person touchpoints.

“There’s a pre-sale and a post-sale funnel, and product usage is the hinge point on both of them.” -- Fynn Glover

The pre-sale funnel is driven almost entirely by product signals. People show up, try things, run tests, invite teammates, and (if all goes well) organically build momentum. No salesperson could replicate the nuance of these signals, and no spreadsheet could reliably predict them. They’re simply the outcomes of a product that has found a willing user.

The post-sale funnel is built around a different set of usage milestones. As adoption grows, new needs emerge: predictability, support, security requirements, usage guarantees, and integrations with internal systems. These are the real needs that show up in workload patterns and day-to-day operations. The best sales teams are tuned into these indicators and meet customers exactly when the product becomes mission-critical.

Both funnels hinge on the same thing: understanding what customers are actually doing.

Zep is a clear example of a company built around this hybrid structure.

Their Flex plan is intentionally easy to start with. It’s affordable, metered, and gives users the freedom to explore without commitment. Developers can build prototypes, test memory and retrieval patterns, and evaluate Zep in a realistic environment. This is the phase where individuals learn whether the product actually solves their problem.

As usage grows, patterns begin to tell a story. Teams start storing more memories, retrieving more data, running multiple projects, and bringing collaborators into the fold. None of this requires a salesperson. But it does create a picture of how the product is being woven into the customer’s workflow.

Eventually, customers reach a point where the Flex plan isn’t sufficient. They may need more predictable costs, or stronger guarantees, or higher throughput. They may need compliance coverage, self-hosted deployment, or an SLA. These are the requirements for running in production, and they naturally lead into Zep’s enterprise plan.

What’s interesting is that the sales conversation at this stage isn’t a pitch. It’s a continuation of work the customer has already done. The product proved itself first. Sales helps the customer turn that proof into a durable partnership.

Companies that succeed with this model tend to have a few things in common.

They invest in understanding usage: not just whether someone signed up, but what they actually did. They design pricing that lets people start small and expand without friction. They build internal visibility so the GTM team knows when meaningful activity is happening. And most importantly, their product, sales, and pricing teams are aligned on the idea that growth doesn’t come from forcing prospects down a single path. It comes from meeting them where they already are.

Hybrid GTM is really about recognizing how people prefer to adopt software today. The product opens the door. Pricing sets the guardrails. Sales steps in when the customer is ready to move from experimentation to commitment.

The move toward hybrid funnels isn’t a trend so much as a correction. It reflects how buyers, especially technical ones, want to evaluate products. They start on their own terms, with their own questions, using their own workloads. If the product holds up, then they’re ready to talk.

“The great thing about product signals is that they’re aligned with value.” -- Fynn Glover

That simple shift rearranges everything upstream: qualification, sales involvement, pricing strategy, and the rhythms of the funnel itself.

Companies that embrace this pattern don’t pit PLG against sales. They let each part do what it’s best at, in the order that makes the most sense. And in doing so, they build a system that feels more natural, more efficient, and far better aligned with how modern software is actually adopted.