“We could just build this in Retool...” — Every startup, right before creating a second product with an infinite roadmap that no one wants to maintain.

Here’s how that typically plays out:

Step 1: Add usage tracking + flags “Let’s just track completions and projects + gate access with a flag” → 1–2 weeks of dev time → Already diverging from roadmap

⬇️

Step 2: Build basic Stripe sync + Retool admin panel “We need to create plans and manage who’s on what” → Fragile logic, no true entitlement model → Manual workarounds for upgrades, trials

⬇️

Step 3: Build a customer portal “We need users to see usage, manage plans, and upgrade” → React components, billing UI, prorations → Deep Stripe integration, edge cases, customer support

⬇️

Step 4: Sales needs help to close deals “Smaller deals need trials. Larger deals need custom plans.” → Custom logic for discounts, free credits, enterprise plans → Now GTM is blocked by engineering

⬇️

Step 5: Product led growth for both new and expansion revenue: overages, alerts, and credits “The product should drive revenue and build pipeline” → Webhooks, alerting, expansion triggers → More complexity, more maintenance

Total cost: months of engineering time + ongoing support

Bottom line: Billing & monetization infrastructure always starts small — and becomes an unmaintained shadow product.

Schematic lets you skip the debt and move fast.That’s why companies like Zep, BlackCloak, TighKnit, and Plotly chose to buy rather than build.

True Stories: In 2022, Contentful spent $3M and 2 years decoupling entitlements from billing. In 2023, BlackCloak spent “hundreds of thousands of dollars on core dev resources" reinventing the wheel around billing and packaging.

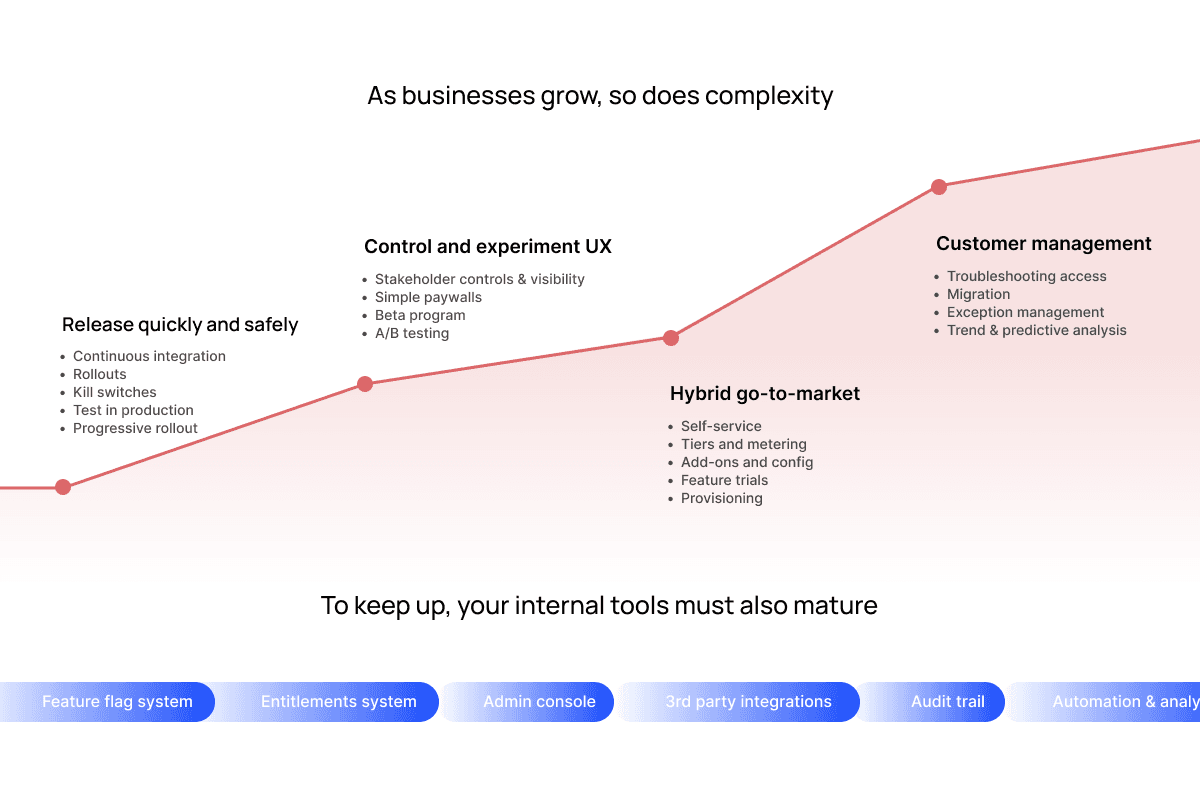

Companies ranging from pre-launch to seed to enterprise are rethinking their approach to monetization so that they avoid hardcoded pricing implementations that drive technical and commercial debt.

What is monetization infrastructure and why does it matter?: Monetization infrastructure includes all the systems that define how customers are charged, what they can access, and how revenue is tracked. It’s foundational to enabling trials, overages, enterprise deals, and usage-based pricing — and it affects both the product and go-to-market motion.

Why do so many startups try to build their own billing systems on top of Stripe?: Because it seems simple at first. Teams often believe they can just “add a few flags” or build an admin panel in Retool, but it quickly snowballs into a complex, fragile system that requires constant maintenance.

What’s the hidden cost of building billing infrastructure in-house?: Engineering time is diverted from core roadmap work. Over time, the billing system becomes a second product — complete with edge cases, manual workarounds, custom UI, and mounting technical debt.

How does DIY billing block go-to-market teams?: Sales and marketing often need flexibility — like trials, custom pricing, or expansion hooks — but these requests get bottlenecked by engineering, slowing down revenue growth.

What are the real-world consequences companies have faced from building instead of buying?: Companies like Contentful and BlackCloak have spent hundreds of thousands to millions of dollars and years of engineering time either maintaining or untangling custom-built billing logic.

How does using a platform like Schematic help?: Schematic lets companies skip the costly, brittle buildout and move fast with flexible, scalable billing logic that supports both product-led and sales-led growth — without diverting engineering focus.